Trends in Water Heating

March 13, 2020 | By Rob Waters

With 2020 upon us, there are several emerging trends that are affecting the water heater industry. In the past I have written about emerging water heating technologies (HPAC, May 2016) where I focused on the technical details of different water heater types. In this article, I will focus more on the regulatory factors that are influencing the Canadian water heater market.

Harmonization of Canadian regulations with those in the U.S. has been a primary focus for the Federal Government over the last several years. The Natural Resources Canada (NRCan) Energy Efficiency Regulations have been updated for many products to match the requirements of the U.S. Department of Energy (DOE) regulations. On October 31, 2018 NRCan published Amendment 14 to the Energy Efficiency regulations, and while it did not contain any new water heater energy efficiency requirements, it did harmonize the testing requirements with those of the U.S.

This has impacted the way water heater efficiencies are now communicated and reported, with the new Uniform Energy Factor (UEF) test requirement replacing the old Energy Factor (EF) test. The UEF test was adopted by the DOE in June 2017 and has been law in the U.S. since then.

The UEF test procedure has been designed to simplify the water heater selection process for consumers and to encourage water heater manufacturers to design energy efficient water heaters to meet specific applications.

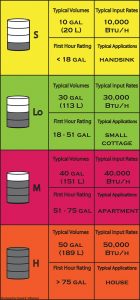

UEF makes it easier to compare one appliance to another by separating water heaters into categories (called bins) based on hot water usage rates. UEF ratings are determined by assigning water heaters into one of four different usage bins and then evaluating their performance based on that usage. The four bins are expressed as either small, low, medium or large. The previous EF test method subjected all water heaters to the same simulated use amount regardless of water heater size. This made it difficult to do apples-to-apples efficiency comparisons between different water heater models when looking at the EF rating.

With UEF testing, the usage bins are based upon the water heaters first hour rating (FDR), which is the amount of hot water the unit can provide in one hour of operation starting with a full tank of heated water. FHR will vary based on the capacity and the heating input of the tank.

By basing the rating on the FHR, the UEF test reflects a more real-world picture of what a homeowner can expect, and it allows for easier efficiency comparison with comparable sized models. Similar to EF ratings, the higher the UEF rating the more energy efficient the water heater is. A water heater’s UEF rating should only be compared with water heaters within the same usage bin. For example, a high bin water heater with a UEF of 0.95 does not perform exactly the same as that of a low bin water heater with a UEF of 0.95.

In Canada all residential water heaters must now display their efficiency with an UEF rating, and any new products must be tested with the UEF test procedure. UEF ratings will now start appearing in manufacturer’s literature and there will be new EnerGuide labels on water heaters.

The new EnerGuide label will show the efficiency expressed in UEF, and it will also show which of the four usage rate bins the tank falls into. Each bin will have a unique minimum energy performance standard (MEPS) efficiency requirement.

Existing products that have already been tested using the existing energy factor (EF) test procedure can still be sold, but they must use a formula to calculate an equivalent UEF rating. Commercial water heaters will not use UEF ratings as they are subject to different rules and regulations and will typically express their efficiency in terms of thermal efficiency percentage.

Another trend emerging in the water heater market is the gradual rise of gas-fired condensing technology, for both storage tank and tankless type water heaters. For tankless units the condensing market recently got a big push forward as new NRCan Amendment 15 Energy Efficiency regulations kicked in on January 1, 2020. Now all residential tankless water heaters <200 MBH input must be condensing technology. Minimum efficiency regulations will be based on the products maximum flow rate: 0.86 UEF for <6.4 L/min and 0.87 UEF >6.4 L/min.

Starting on July 1, 2023 commercial units >200 MBH input will also require all condensing technology with efficiency regulations of minimum 94% TE.

At this time, there currently are no NRCan regulations that require storage tank water heaters to be condensing technology. This is likely to change in the next few years as NRCan have expressed aspirational goals to get to condensing level for all water heaters by 2025. We’ll have to wait and see if and when this happens.

For now there are growing markets for condensing products in Ontario and B.C., but due to quite different reasons. In Ontario, condensing water heaters are being mandated for some new homes to meet the requirements of the Ministry of Housing’s Energy Efficiency for Housing Supplemental Standard SB-12. Several of the most popular compliance packages in SB-12 require that water heaters must be condensing, and this has certainly increased the usage rate of condensing water heaters.

In B.C. the market is being spurred forward with a softer, more voluntary approach. The gas utility, FortisBC, is currently incentivizing the market by offering rebates of $1,000 for water heater retrofits that utilize storage type or tankless condensing water heaters.

Outside of these regions non-condensing storage water heaters are still the primary products being installed. Condensing units continue to be a tough sell due to much higher costs. Condensing storage water heaters are typically about double the cost of a non-condensing water heater, and also require significantly more labour due to additional installation requirements with venting, piping and condensate disposal.

Incentive programs like those in B.C. help to reduce the sticker shock for condensing equipment, and the market for condensing water heaters across the country should continue to grow if more gas utility companies introduce these types of incentive programs.

The last trend to look into is the drive towards electrification that is happening in some areas of the country. Climate change issues are coming to the forefront frequently, with some jurisdictions declaring climate emergencies and starting to look at ways to eliminate fossil fuel equipment completely.

Vancouver and Toronto both declared a “climate emergency” in 2019, and are both looking at ways to reduce greenhouse gas emissions from all sectors, including from space and water heating equipment. In Vancouver, as part of the city’s “Climate Emergency Response Report” from April 2019, they have adopted a new target that will require all new and replacement heating and hot water systems to be zero emissions by 2025. To meet this target Vancouver expects heat pumps to be an important solution in the transition.

On the federal level, in 2018 NRCan published its aspirational goals for market transformation for space and water heating technologies. The long term goal for 2035 is for all water heating technologies for sale in Canada to have an energy performance of greater than 100%. To meet this long-term aspirational goal all water heating technologies would need to achieve a performance equivalent to that of a heat pump.

As you can see, there are high expectations for heat pump water heaters (HPWH) by policy makers. HPWH’s have been around for some time, but the market for them in Canada is growing very slowly.

It is safe to say the market is past the experimentation stage, but widespread adoption is nowhere close. There are still hurdles for HPWH’s to clear before they become more widely adopted.

The two primary issues are the concerns about operating HPWH’s in cold climates, and the high initial cost of the equipment. HPWH also have slower recovery rates compared to gas WH technology, and increased space requirements which may make them less suitable for some applications.

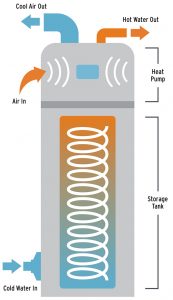

There are lingering concerns about the suitability of HPWH’s in Canada’s cold northern climate. When the HPWH is installed in a heated building it draws room air into the unit and uses the heat pump refrigeration cycle to heat the water in the tank. The room air gets cooled and pushed back in the space where it must be reheated by the space heating system. This reduces the overall efficiency of the unit in winter months and leaves some questioning “are heat pump water heaters worth it?”

To help answer this question there are several NRCan-sponsored pilot programs currently running across Canada in B.C., Nova Scotia, New Brunswick and Manitoba. These HPWH pilot programs have installed both integrated units and split CO2 heat pumps to evaluate their performance and savings potential. When these pilot programs are finalized, there will be hard data available to help answer the question above.

HPWH’s typically cost almost four times more than a conventional electric resistance water heater. However the energy savings from a HPWH can be substantial due to their extremely high efficiency. With UEF’s as high as 3.7 they will use much less energy than a conventional electric water heater which typically has a UEF in the 0.93 range.

In areas with high electrical costs this can make a HPWH a product some will consider. But with electricity costs substantially more than natural gas, the likelihood of someone voluntarily switching a gas fired water heater to a HPWH is very slim. So if the drive to electrification continues, governments can expect push back from consumers who will see their costs increase dramatically.

As 2020 begins the water heating market in Canada is evolving with new regulations, climate change concerns and government policies. What will be the dominant types of water heating equipment installed in Canada in 2030? I’ll have to get back to you on that.