Double-digit drop in building permits

February 7, 2024 | By Adam Freill

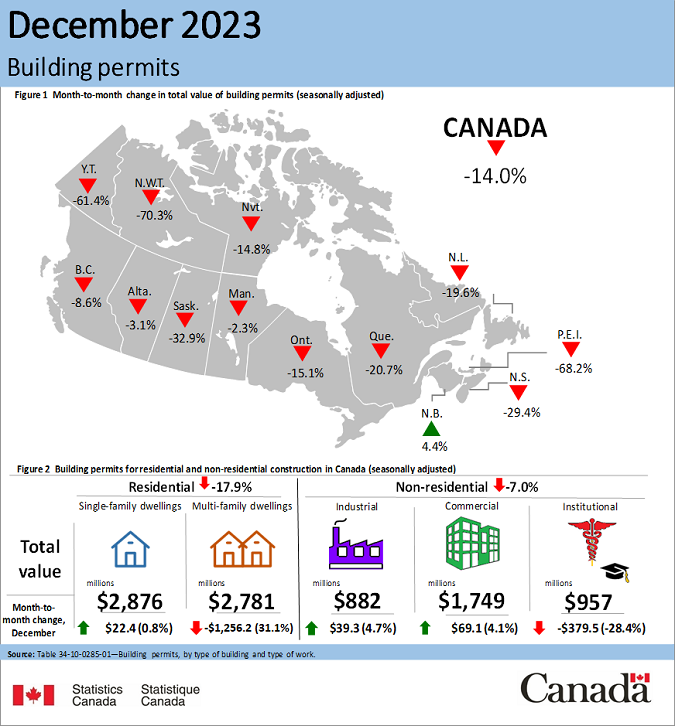

Statistics Canada indicates a 14% monthly fall in December construction intentions as permits roll back to 2020 levels.

December’s total value of building permits in Canada fell 14% from November, coming in at $9.2 billion, the lowest monthly level since October 2020.

According to the most recent figures shared by Statistics Canada, declines were recorded in both the residential and non-residential sectors, however two segments were the main drivers of the dip: multi-family residential and institutional.

The total value of residential permits fell 17.9% to $5.7 billion in December, driven by a 31% decline in multi-unit construction intentions, the largest monthly drop in the series. The 45% decline in Ontario’s value of multi-unit permits was a key contributor to the overall monthly decrease.

Meanwhile, construction intentions in single-family dwellings actually edged up for the month, rising 0.8% to $2.9 billion. A 15% gain in Alberta more than offset declines in seven provinces. Growth in single-family construction intentions in Alberta hit their largest monthly value since January 2014.

On the whole, non-residential sector permits decreased 7% in December, to land at $3.6 billion.

Fourth Quarter

The total value of building permits in the fourth quarter of 2023 was $31.3 billion, down 9% from the previous quarter, and 1.7% from the fourth quarter of 2022.

The total value of building permits in the fourth quarter of 2023 was the lowest quarterly level reported since the $30.8 billion reported in the third quarter of 2021.

Non-residential permit values were down 13.3% from the third quarter to the fourth quarter of 2023 to sit at $11.6 billion for the quarter, while residential dipped 6.3% to land at $19.7 billion.

Full Year 2023

Year over year, the total current dollar value of building permits fell 3.2% to $132.2 billion in 2023. However, Statistics Canada explained that rising material and labour costs inflated nominal building permit valuations, which masked some of the true decline.

On a constant dollar basis, using 2017-dollar values, the total annual value of building permits decreased 8.9% from 2022.

In constant dollars, the residential sector experienced its second consecutive annual decline in building permit values, dropping by 15.5% to $48.3 billion in 2023, while the non-residential sector rose for the third consecutive year, up 1.7% to $35.9 billion in 2023.

The institutional component gained 14.4% and the industrial segment was up 4.1% as both experienced series highs in construction intentions, leading to an overall growth increase in the non-residential sector. However, growth in the non-residential sector was tempered by a 6.1% decline in the commercial component, which accounted for almost half of the value of construction intentions in the non-residential sector.

Drivers of growth

The gains in the institutional component were mostly attributed to large construction intentions for hospitals and long-term care facilities. The demand on the Canadian healthcare system has been magnified in recent years due to the COVID-19 pandemic and Canada’s aging population.

A variety of public policies have been announced to address the high demands on the healthcare system, including investments from various levels of government like the federal Canada Health Transfer top-ups, and bilateral agreements between governments.

In 2023, the largest building permit issued was for a new hospital in Vaudreuil-Dorion (Quebec), with an estimated construction value of almost $1 billion. Construction intentions for hospital permits that cost over $100 million were recorded in Montréal and the Greater Toronto Area, as well as throughout B.C., specifically in Dawson Creek, North Cowichan, Williams Lake and the Greater Vancouver Area.

Building permits for long-term care facilities also bolstered growth in the institutional component, with large construction intentions concentrated in Ontario, Quebec and Nova Scotia.